Briefing Database: May 2020

Law firms that choose to specialise more are managing to outperform others in the market in terms of some key metrics, but they experience higher overheads, according to latest data from Peer Monitor.

_______________________________________________________________

Peer Monitor Perspective

_______________________________________________________________

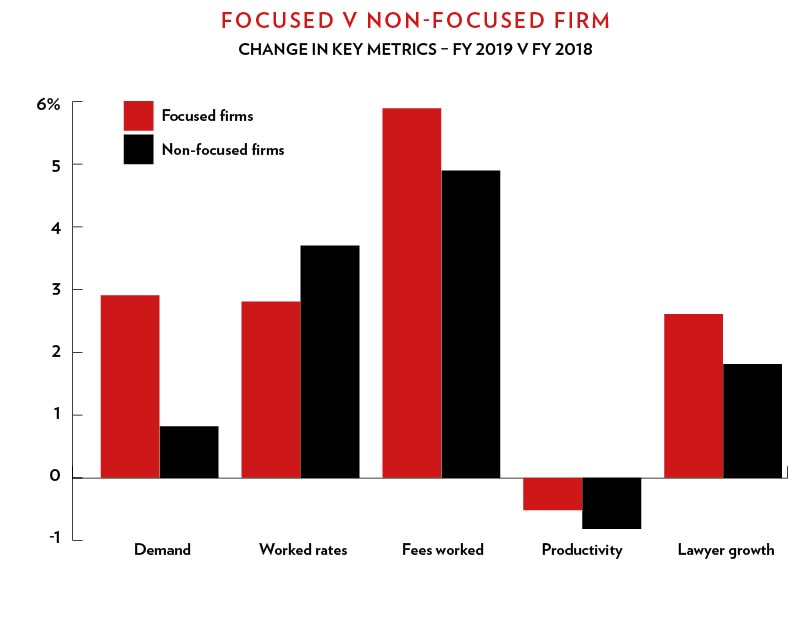

The growth of boutique firms continues across the legal market. For these ‘focused firms’ – meaning that they have at least 50% of their total hours worked consolidated in a single practice – demand growth averaged 2.9% in 2019, significantly outpacing the 0.8% growth seen by the rest of the firms in the Peer Monitor database. Average worked rate growth was lower among the focused firms group, but the average fees worked outpaced all other firms and productivity declines were down due to higher demand.

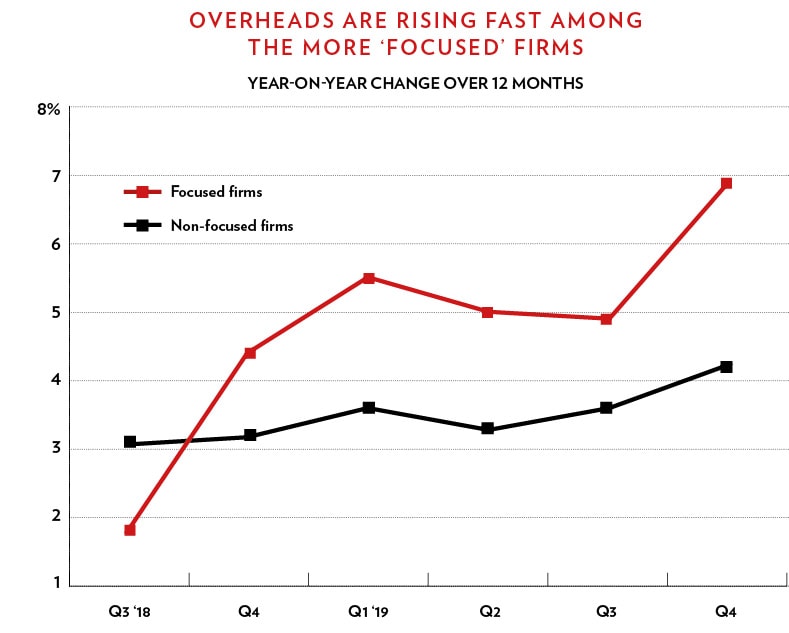

Overhead expenses are growing faster, however. In fact, overhead growth at these firms has only dipped below 5% once, and only bottomed out at 4.9% among focused firms over the last year. By contrast, non-focused firms have only recently surpassed the 4% average growth mark, reaching 4.2% growth on average in the fourth quarter. Notably, focused firms are also increasing their recruiting and technology expenses at faster rates than the non-focused group.

In partnership with Peer Monitor

This article can be found in Briefing’s May edition: It’s the screen team